In the age of digital payments, why are tellers still handling checks at the counter?

In today’s day and age, one would suppose that hardly anyone uses the venerable paper check anymore. Checks, the epitome of low-tech payment, have been around since at least 300 BC at Indian banks1. The Internet and mobile banking were supposed to kill the check long ago.

The Payment Landscape

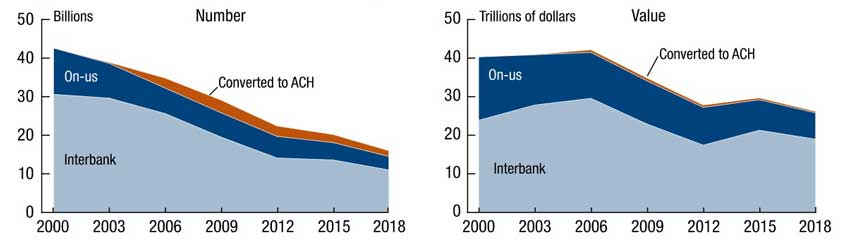

Surprisingly, checks remain a huge piece of the payments landscape for banks and credit unions. In 2018, there were 14.5 billion check payments made in the USA, according to the Federal Reserve2. Check usage is forecast to decline annually by 7%. But even so, there will be billions of checks to process for years to come. The value of check payments is also in decline. This is double trouble for banks and credit unions who still must process checks.

Trends in checks written, by number and value, 2000–18

The reality is that customers will continue to bring checks to the counter at bank and credit union branches. Processing a single check at the counter consumes several minutes of human work, work that can and should be automated. This busy work detracts from time the employee could spend on customer interactions that could increase revenues and profits.

Humans sometimes make mistakes and enter the wrong data. Customers are unhappy with the resulting payment delays, and correcting the error consumes even more human work time. Wouldn’t you prefer their time should be spent on higher-value interactions with every valuable customer that walks through that door?

The Sense of Urgency

The brick and mortar branch of the 2020s must be focused on providing a positive customer experience. You also have valuable products and services that can help the customer and increase the branch’s revenue and profits.

Every bank and credit union must increase the amount of time employees can spend engaging in higher value interactions with customers. One obvious way to increase time for this is by reducing the amount of checks that customers bring into the branch and by automating the handling of checks that do make it to the counter.

Remote Deposit

You might think to yourself, “Wait a minute, we already offer a mobile app with remote deposit.” As a user of several different mobile banking apps, I can talk personally about how these apps often absolutely suck at remote deposit. The phone camera struggles to capture the check image, even as I dance creatively over the check holding my phone on one hand at increasingly nonsensical angles while turning lights off and on and closing the curtains with my other hand. And then, I must duplicate this for the back of the check.

It’s a no-brainer to understand that remote check deposit via app must be easy to use and work the first time, or customers may abandon you and even post negative reviews online.

Evaluating Check Processing Automation

As a software expert I know that remote deposit, as well any successful and sustainable check automation process, is dependent upon the software components. The software must very accurately read the data from even the poorest-quality scanned images, do it at the highest possible speed, protect against fraud and make it easy for my team to resolve any exceptions.

When evaluating check process automation software, I look for the following characteristics:

- The highest recognition accuracy with the best courtesy and legal amount recognition rates. This must be demonstrable in your proof of concept.

- MICR line recognition results that are higher than the results from magnetic readers, especially useful for those applications where a magnetic reader is not available such as mobile remote deposit.

- Image quality assessment that leverages Financial Services Technology Consortium (FSTC) compliant image quality metrics to determine if any of the conditions related to image quality are encountered for an image. This means you will improve the integrity of images, minimize risk by identifying and fixing low-quality items, reduce costs associated with researching poor image quality, and ensure that the images meet image exchange requirements based on industry standards.

- Image usability verification performed by discreetly processing each required field to both determine the presence of data and whether the data can be successfully recognized. It should also detect back-of-check endorsements. All of this means that your solution can evaluate whether the check can be accepted automatically instead of dealing with a costly exception handling after-the-fact.

- CAR/LAR mismatch detection between the check amount handwritten in numbers (courtesy amount) and the letters (legal amount). The software must accurately read both fields and detect if the results are different. For superior accuracy, the CAR/LAR mismatch conclusion should consider multiple factors and not rely solely on recognition results. When a mismatch is detected, a confidence value of mismatch should be returned as an answer. This helps to detect counterfeits and alterations. Insist on this functionality to safeguard your company and your customers against losses due to fraud.

Waiting to implement the best possible automation solution for your check processing is simply not an option. Competition for the customer’s wallet share has never been fiercer. I recommend that you immediately start a review process of your check processing software and discover ways to further reduce the number of checks presented at your branch counters.

—

1 Payment Systems in India, The Reserve Bank of India, December 1998

2 The 2019 Federal Reserve Payments Study, December 2019

If you found this article interesting, maybe you would like to learn more about Parascript check processing automation, and if you’d like to speak with us directly, please feel free to reach out.