The advent of new channels and devices available for interacting with financial institutions has increased customer choices for remote deposits among other activities while simultaneously creating greater risk. Whether intentional or by accident, the potential for a check to be altered or deposited multiple times on different dates or at different institutions are real and persistent issues. When dealing with remote deposit a variety of problems can occur that financial institutions prefer to avoid.

One challenge is the potential for someone depositing a check remotely to alter the amount of the check. Typically in check automation and recognition, financial institutions focus on the numeric amount or “courtesy amount” (CAR). The written amount is only secondary because it is much more difficult to decipher. Since it’s fairly simple to alter the numeric courtesy amount, it’s prone to fraud. One way of dealing with this is to compare the numeric courtesy amount with the written legal amount (LAR). At the bank, tellers look at both and make sure that they are identical amounts when a customer makes a deposit in-person. ATMs and other forms of remote deposit require deposit validation that can be a purely manual-intensive review process of each deposit amount to validate everything is in synch. With advanced validation software, such as Parascript CheckPlus and CheckUltra, it’s possible to automatically detect anomalies between the numeric courtesy amount and the written legal amount, referred to as a CAR/LAR Mismatch.

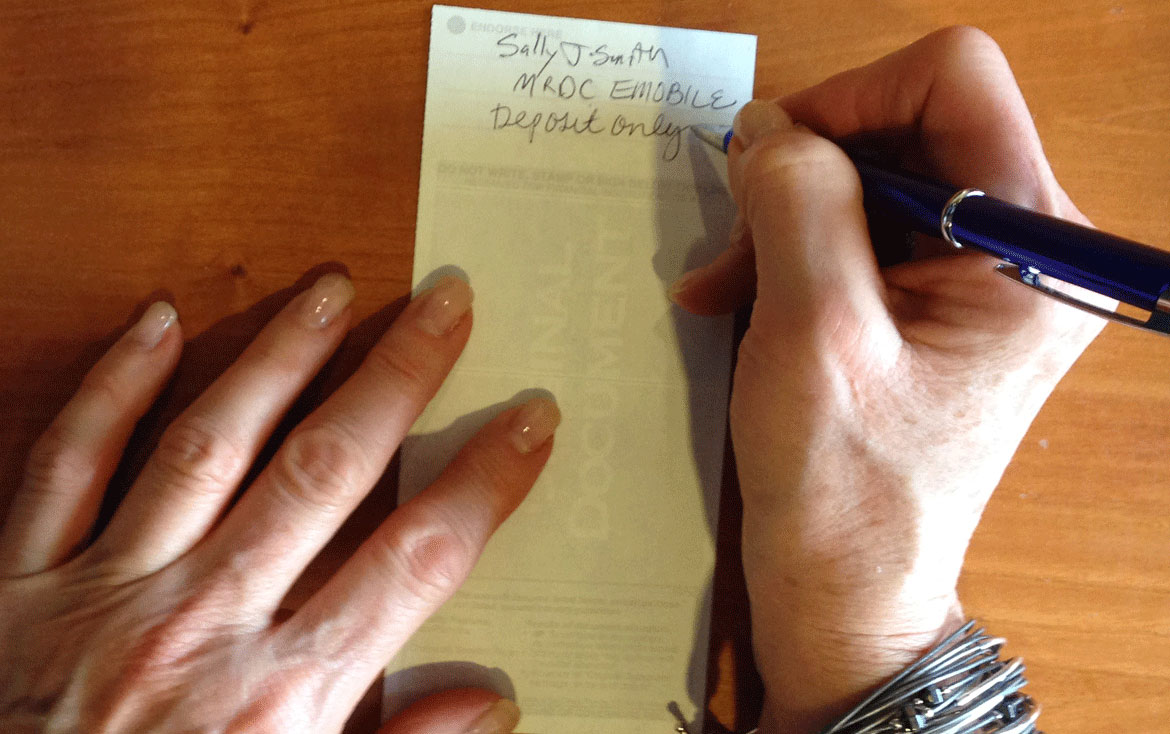

Another problem is duplicate deposits. If a check is scanned or photographed for remote deposit, the hard copy still exists and could potentially be deposited into another account. To avoid this, the industry is increasingly looking to the concept of restrictive endorsement where the individual writes on the back of the check where the check is endorsed with a number or statement (e.g., “edeposited at XYZ Bank”) so if another institution receives the same check, it will be treated as invalid to be deposited. The complexity is that the financial institution needs to have the ability to automatically detect that these statements are on the back of the check when there’s an acceptance of a mobile or other remote deposit. That requires detection of handwritten script and actual recognition of the characters. Automating this review process allows the financial institution to provide better customer service by more rapidly recognizing valid deposits and reduce overhead. In fact, one of Parascript’s partners has implemented Parascript’s technology to support these validation capabilities—reducing the potential for duplicates—for financial institutions in the Midwest

Combating the problem of duplicate deposits of business, personal, internal or traveler checks, money orders or image replacement documents (IRDs) is an ongoing challenge that requires restrictive endorsement and amount validation. Parascript offers a unique combination of presence/legibility detection and field recognition capabilities that allow for significant optimization and automation of a fraud detection process, reducing the number of potentially fraudulent items that are treated as legitimate.

Parascript advanced image analysis, intelligent classification and data extraction applications are available today to financial institutions through their technology providers across the United States. To find out more, contact us.