Is Your Mortgage Automation System Ready?

Who should read this: USA mortgage lenders; system integrators.

The coronavirus outbreak is affecting many areas of commerce and business. Apple warned it will miss its quarterly sales forecast. Mobile World Congress, the largest phone conference in the world, was cancelled due to concerns about the epidemic. A new report from Dun & Bradstreet ominously predicts up to 5 million businesses worldwide will be negatively impacted.1

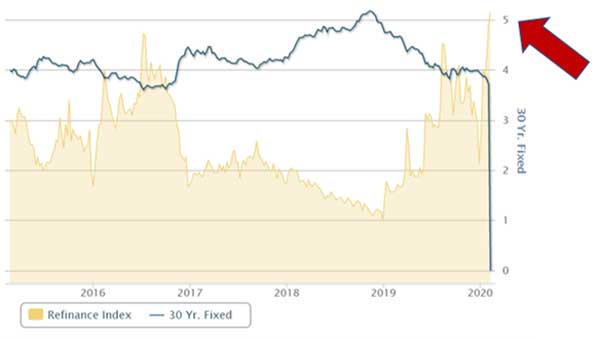

But the outbreak is having just the opposite effect on U.S. mortgage markets. “The refinance index climbed to its highest level since June 2013,” said Joel Kan, Associate Vice President of Economic and Industry Forecasting for the Mortgage Bankers Association. “Rates remained close to their lowest levels since October 2016, and last month was the strongest January for purchase applications since 2009.”2

“The virus definitely deserves credit for the extra downward momentum (on rates) in recent weeks,” opined Matthew Graham, COO of Mortgage News Daily. He also pointed out that 2019 was already the best year for mortgage rates since 2011.3

Here Come the Loan Files

The initial loan approval is now the fastest and easiest part of the process, thanks to online submission processes. The hard part comes next. When refi application volumes leap like this, lenders will soon be inundated by a deluge of new loan files from the applicants.

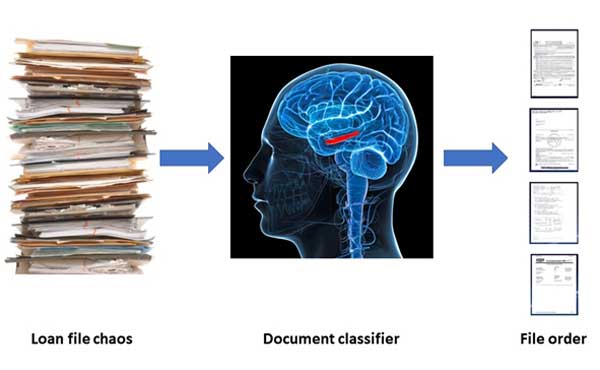

Loan file review is the most critical stage of the loan process. The steps involve reading the file contents, sorting and verifying the documents, and extracting data. It is also an incredibly labor-intensive process prone to human and software errors. If anything goes wrong at this stage, the rest of your process is affected.

A single mortgage loan file can contain over 100 diverse loan forms and documents. Federal agencies, states, counties and cities have different forms and regulations with an endless variety of file formats. Applicants cannot be counted on to submit high-quality scanned or phone camera snapped documents. Poor quality source documents are the curse of every automated system. Loan files often contain images that are unreadable by most systems. Applicants also forget to file documents.

Every loan file must be thoroughly reviewed; every document in it must be sorted, verified and filed; and data must be extracted correctly and matched to a database. One poor quality or missing document, or one incorrect piece of data, can stop the loan dead in its tracks until humans resolve the issue.

If you have ever refinanced or taken out a new mortgage to buy a house, you know the anxiety, stress and extra cost of delays. As a mortgage processor or service provider, you must provide a speedy customer experience for two fundamental business reasons:

- Faster processing means faster capital realization for your company.

- Delays mean you risk losing your customers to competitors.

How efficiently does your system process a loan file? How automated is this step? Are you still seeing too many exceptions and human interventions that cause delays? Does your current solution continually miss data that is essential for compliance?

Who Is Reading Your Loan Files?

To improve your mortgage automation process, you should be using the best possible document classification technology. If loan file processing were a human body, document classification would be the eyes and the brain. Eyes to read, and a brain to learn and to process the information.

Now is a good time to review the brains and eyesight of your system, and ensure you have the best of both.

As a software expert with over twenty years’ experience at providing solutions for mortgage automation, here are four questions I ask when evaluating document classification software tools.

- Does it use trainable machine learning (ML)? Many document classification solution providers say they use ML, but still depend heavily on Subject Matter Experts (SMEs) to assemble document samples. With potentially hundreds of diverse document types, this is resource-intensive, time-consuming and costly. Look for tools with highly advanced ML that can automatically learn a new document class with only a few samples, and augment or even replace SMEs. Don’t be misled by vendors who fly the AI flag. AI without advanced ML is not productive.

- Can it apply multiple document classification techniques? Look for a solution that organizes documents based not only on features and text, but also on imagery and handwritten information on the document including the presence of signatures. Documents with sensitive information such as handwritten social security numbers can be included in your classification workflow and easily identified. Regardless of how the information is presented, classification should be based upon all the available information in the document, not just a select subset of that data.

- Does it provide an accessible and clear-cut user interface for business users? Let’s face it: this is a very sophisticated and complex software operation. Look for a solution with a user interface that doesn’t require programming skills. Fine-tuning document classes should be as simple as correcting results by dragging and dropping results from one class to another, then re-running the task. The best solution will hide the complexity without compromising the flexibility.

- Does it offer high accuracy with low error rates and do that at top speed? Normally performance would be the main consideration. I saved it for last, because if my first three questions aren’t adequately answered, the performance results can never be maximized. Most classification systems become slower and less accurate in cases such as mortgage automation where several hundred document types are involved. Advertised accuracy rates are a bit like the miles per gallon sticker on a new car. Actual mileage will vary with options, driving conditions, driver’s habits and vehicle condition. This must be demonstrable in your proof of concept.

Don’t Waste a Crisis

There is a popular saying in politics and economics: don’t waste a good crisis. This time, it was a pandemic that caused mortgage rates to dip and refi applications to soar. We don’t know what or when the next crisis will be. Waiting to implement the best possible document classification solution is simply not an option for any mortgage processor. I recommend that you immediately start a review process of your document classification software by contacting an expert.

—

3 http://www.mortgagenewsdaily.com/consumer_rates/935687.aspx

###

If you found this article interesting, you may find this short webinar useful on straight through processing for mortgages: